how are rsus taxed in the uk

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The UK tax treatment for RSUs is similar to how your salary is taxed.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

At this point the employee is charged to income tax on 30.

. The gain from the sale of shares is subject to tax as capital income at 30 percent up to. How Are Restricted Stock Units RSUs Taxed. Get consistent tax treatment and timing.

This is a common misconception because stock options are taxed when they are exercised. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. This is different from incentive stock.

Restricted Stock Units RSUs have become a popular type of. RSU vested in 202122 tax year. An RSUs grant does not typically constitute taxable incomeA RSUs vest first in cash then it is taxed as.

There are various occasions when RSUs may attract taxes in the UK when owned by someone who is UK tax resident and reporting the taxation which is not handled by the. Shares typically vest in tranches over a period of timefour years is common. Its vital to remember that RSUs are taxed at vestingnot at an exercise.

Essentially the RSU is then treated as a stock option for UK income tax and NIcs purposes and the tax charge arises under the employment-related securities provisions. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. There is no tax to pay when RSUs are granted.

Yes you would enter it under this section of the foreign pages as well as the amount of RSUs included in the employment section. Less Employer National Insurance 138-2760. Net RSU Value Before Employer Income Tax NI.

You only pay tax on RSUs when they vest. You are correct in your understansding. There is no tax to pay when RSUs are granted.

If you already earn in excess of this and the RSUs. Postpone shareholder dilution until the time of vesting. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax.

The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut. The UK tax treatment for RSUs is similar to how your salary is taxed. You will pay income tax and national insurance on the value.

Companies use units instead of the actual restricted stock or shares because they can. RSUs are taxed as income at vesting. The UK tax treatment for RSUs is similar to how your salary is taxed.

Rsus Vs Nqsos Financial Planning Tips For Expat Executives At Multinationals Creveling Creveling Private Wealth Advisory

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

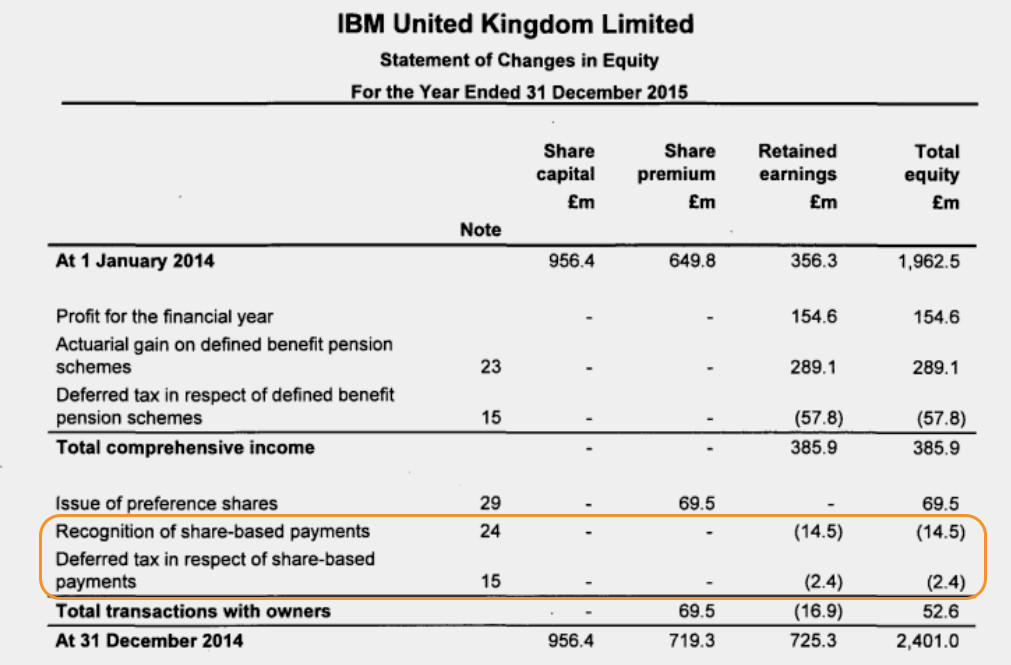

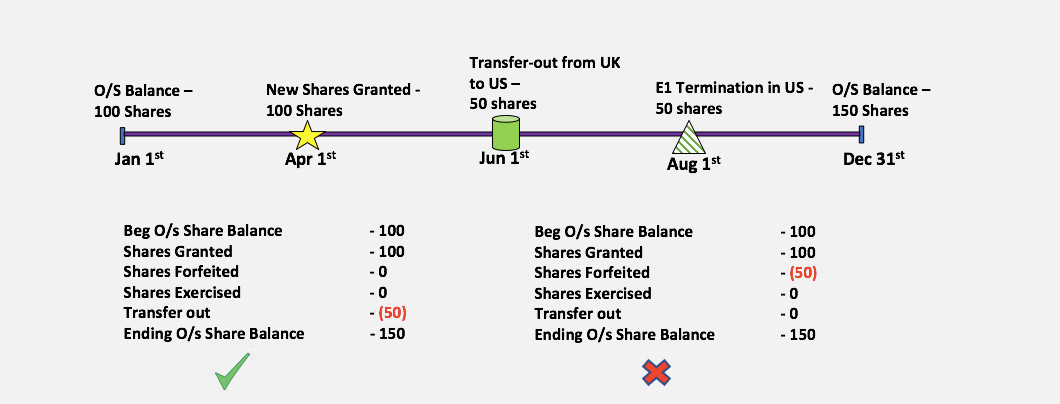

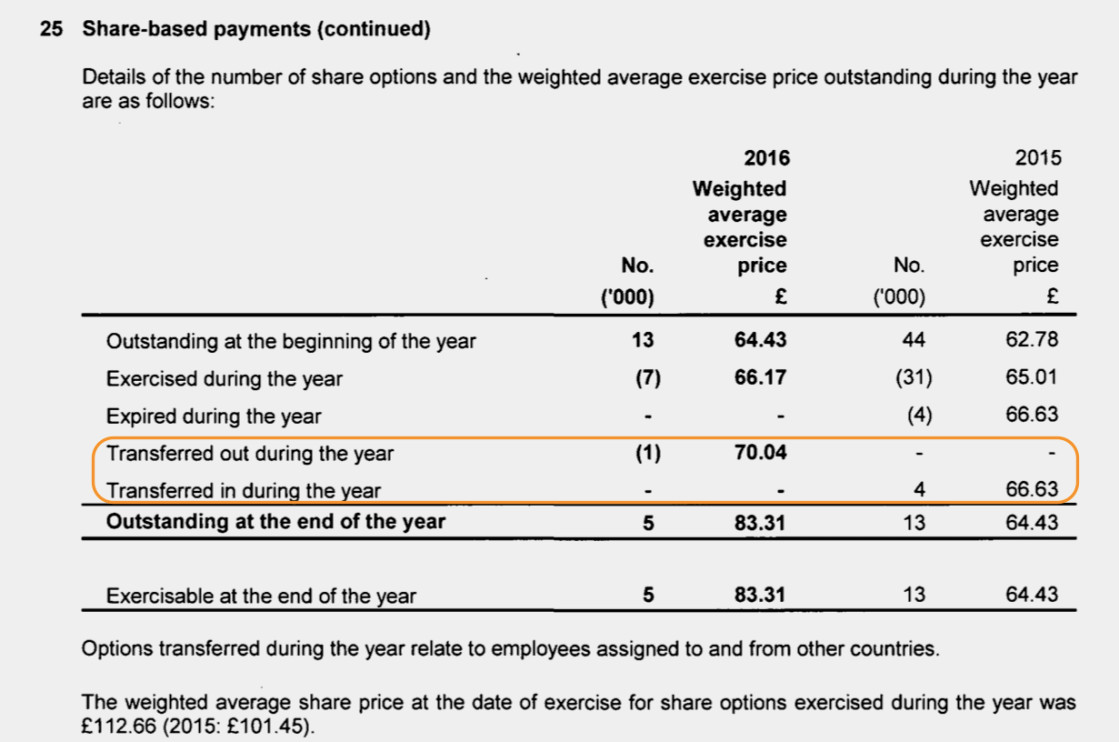

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

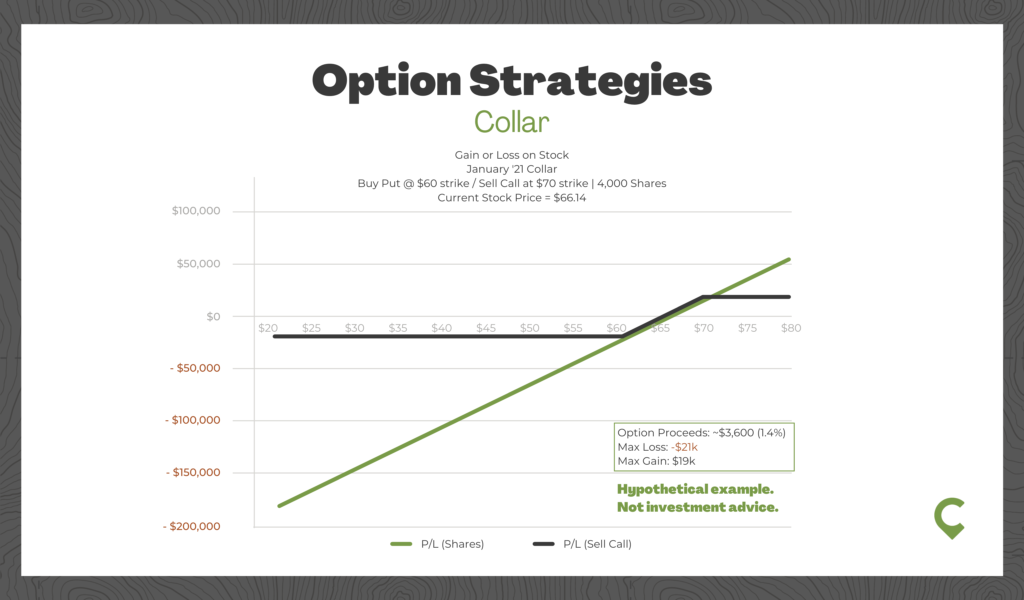

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Draft Finance Bill 2016 Restricted Stock Units

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Rsus Vs Nqsos Financial Planning Tips For Expat Executives At Multinationals Creveling Creveling Private Wealth Advisory

Draft Finance Bill 2016 Restricted Stock Units

Rsu Taxes Explained 4 Tax Strategies For 2022

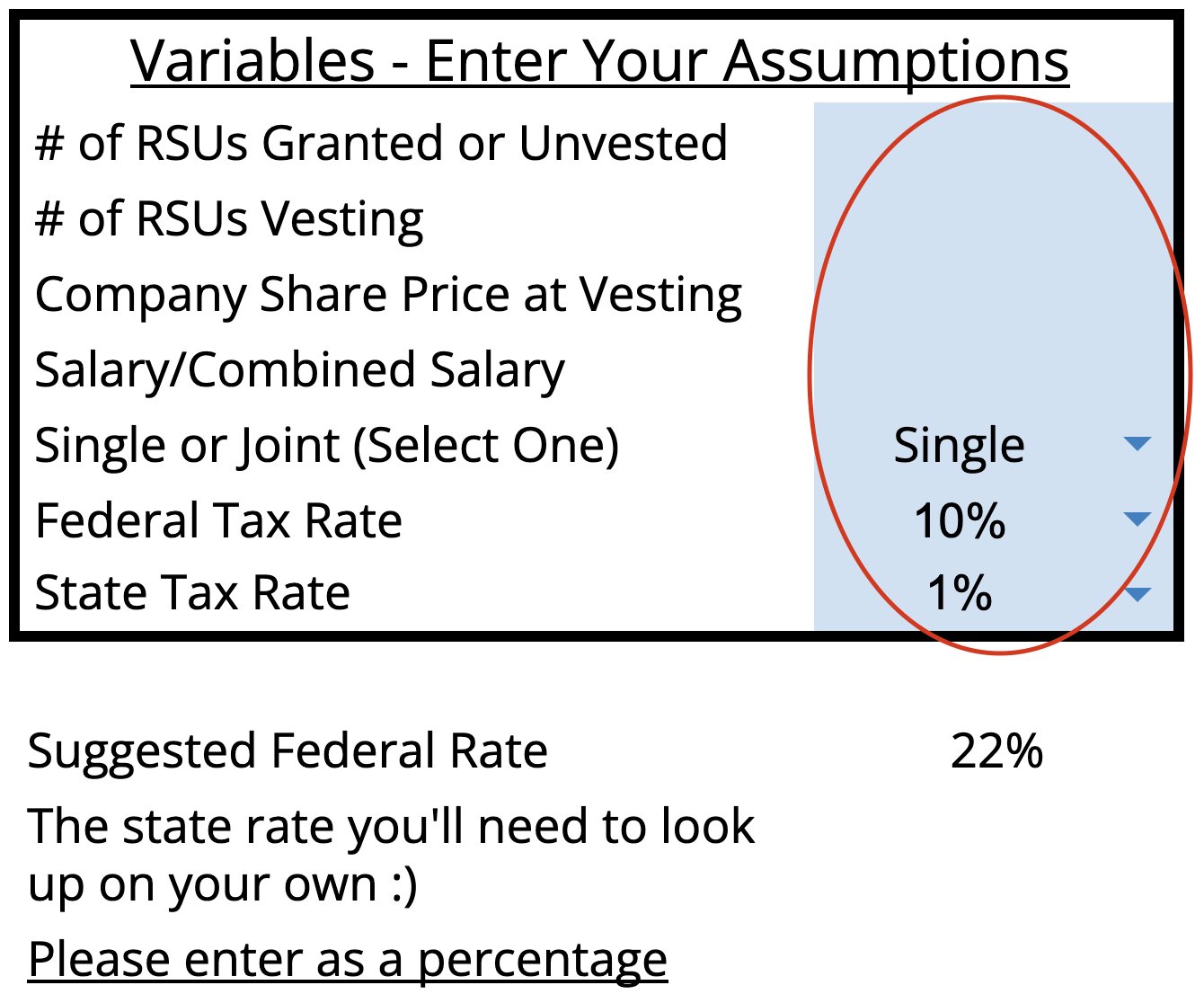

Restricted Stock Unit Rsu Tax Calculator Equity Ftw